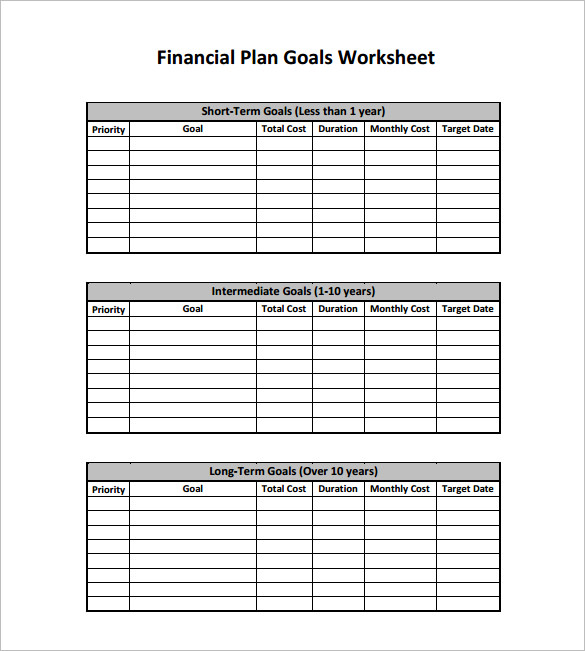

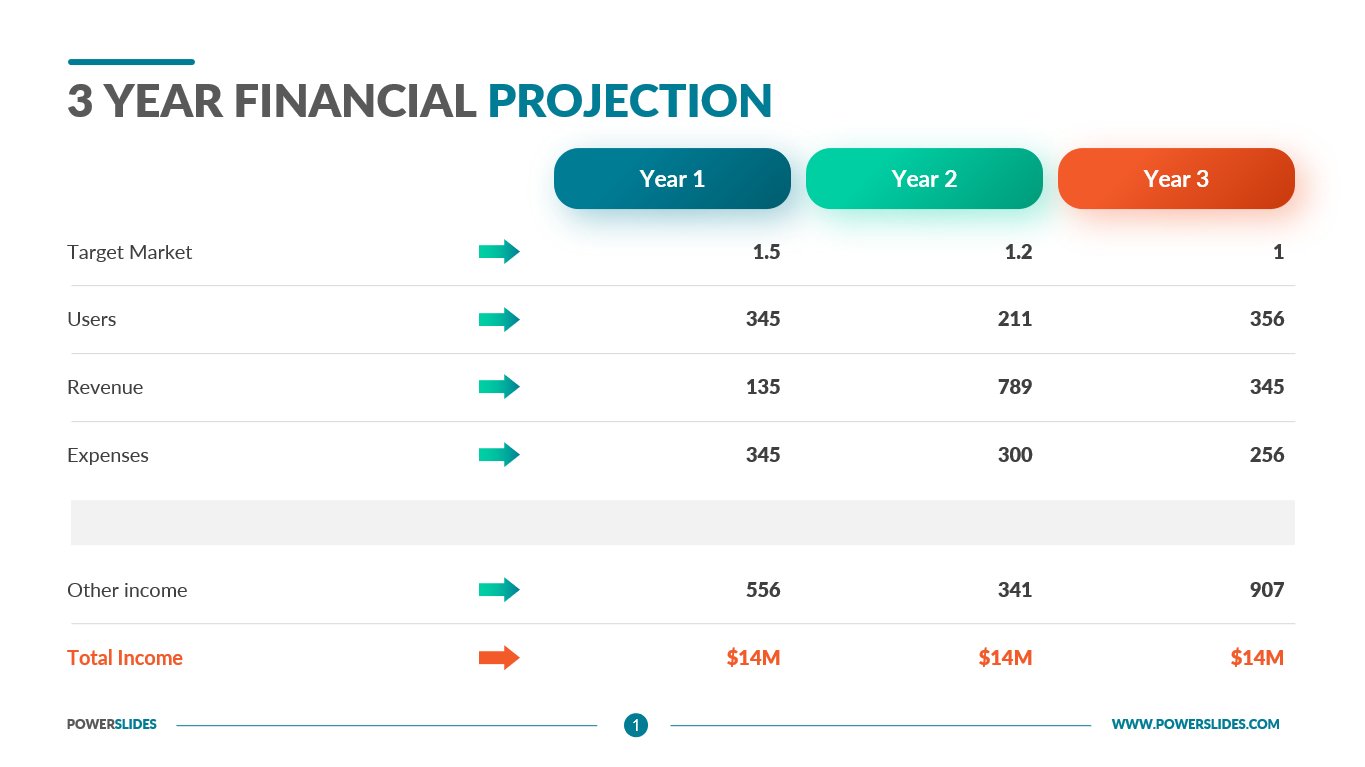

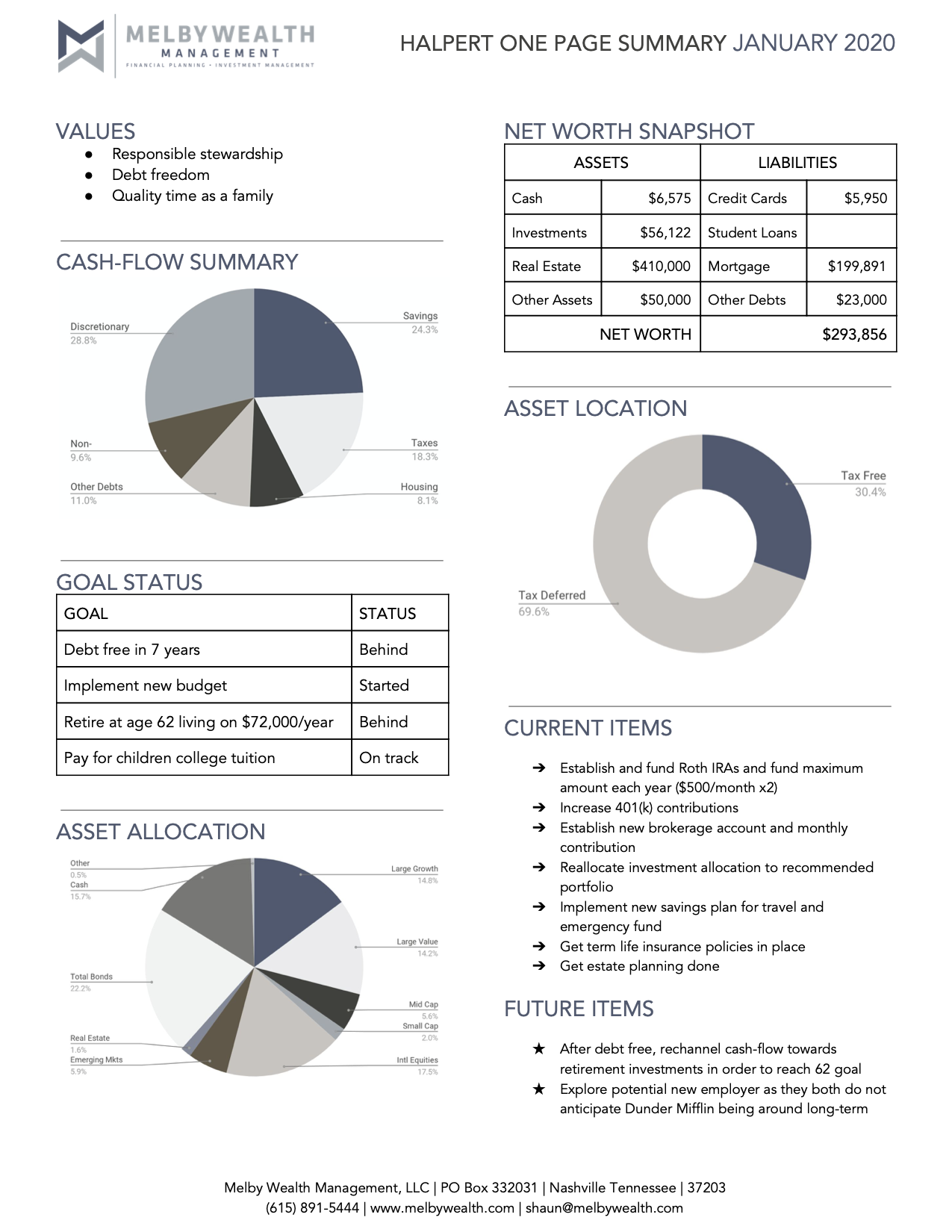

html Unlock Your Financial Future: Grab This FREE 1-Page Financial Plan Template Now! Feeling overwhelmed by the idea of financial planning? You're not alone. Juggling expenses, savings, and investments can feel like navigating a maze. But what if you could simplify the process and gain clarity on your financial goals? This article provides a roadmap to financial freedom, starting with a simple, actionable tool: a FREE 1-page financial plan template. This guide will walk you through the key components of personal finance, equipping you with the knowledge and resources to take control of your money and build a brighter financial future. Why a Financial Plan Matters A financial plan isn't just for the wealthy; it's a crucial tool for anyone wanting to achieve their goals, whether it's buying a home, retiring comfortably, or simply reducing debt. Think of it as a GPS for your finances. It helps you: Define Your Goals: Clearly identify what you want to achieve (e.g., pay off student loans, save for a down payment). Track Your Progress: Monitor your income, expenses, and investments to see how you're doing. Make Informed Decisions: Understand the impact of your financial choices. Reduce Stress: Knowing where your money is going and what you're working towards can significantly reduce financial anxiety. Without a plan, you're essentially drifting, hoping to reach your destination. A financial plan provides direction and allows you to adjust your course as needed. According to a study by the Financial Planning Association (FPA), individuals with a financial plan are more likely to feel confident about their financial future. [You could link to the FPA website here]. The Power of a 1-Page Financial Plan The beauty of a 1-page financial plan is its simplicity and accessibility. Unlike lengthy, complex plans that can be intimidating, a concise template allows you to quickly summarize your financial situation, goals, and strategies. It's a starting point, a living document that you can easily update and revisit. Key Components of a 1-Page Plan Our FREE template (which you can download [Insert link to your download page here]) covers these essential areas: Income: List all sources of income (salary, side hustles, etc.). Expenses: Track your monthly spending. Categorize them (e.g., housing, food, transportation). Net Worth: Calculate your assets (what you own, like savings and investments) minus your liabilities (what you owe, like loans and credit card debt). Goals: Define your short-term and long-term financial goals (e.g., saving for a vacation, retirement). Savings & Investments: Outline your savings rate and investment strategy (e.g., 401(k) contributions, Roth IRA). Debt Management: Summarize your debt situation and your plan to pay it off (e.g., debt snowball or debt avalanche). By breaking down these components, you can gain a clear picture of your current financial standing and create a plan to achieve your desired future. How to Use the FREE Template and Get Started Using the template is straightforward. Here's a step-by-step guide: Download the Template: [Insert link to your download page here]. Gather Your Information: Collect your bank statements, credit card statements, and any other relevant financial documents. Fill Out the Sections: Enter your income, expenses, assets, liabilities, and goals. Be as accurate as possible. Use budgeting apps or spreadsheets to help. [Suggest a link to Mint or YNAB here]. Set Realistic Goals: Be specific and set deadlines. Instead of "save money," write "save $5,000 for a down payment on a car by December 2024." Review and Adjust: Review your plan regularly (monthly or quarterly) and make adjustments as your circumstances change. Example: Let's say Sarah earns $60,000 annually, has $1,000 in monthly expenses, and wants to save for a down payment on a house. Her 1-page plan would include these details, along with a savings goal of $20,000 within 3 years. She'd also outline her investment strategy (e.g., contributing to a high-yield savings account). This provides a concrete roadmap for her to follow. Beyond the Template: Building a Strong Financial Foundation While the 1-page plan is an excellent starting point, building a robust financial foundation requires ongoing effort and learning. Consider these additional strategies: Create a Budget: Track your spending and allocate your income effectively. Build an Emergency Fund: Aim for 3-6 months' worth of living expenses in a readily accessible savings account. Reduce Debt: Prioritize paying off high-interest debt. Invest Regularly: Start investing early and consistently, even with small amounts. Research different investment options, such as stocks, bonds, and mutual funds. Consider working with a financial advisor. [Suggest a link to the SEC website here]. Protect Yourself: Have adequate insurance coverage (health, life, and disability). Continuously Educate Yourself: Stay informed about personal finance through books, articles, and online courses. Conclusion: Your Financial Future Starts Now Taking control of your finances doesn't have to be daunting. With our FREE 1-page financial plan template, you can simplify the process, gain clarity, and start building a brighter financial future. Remember, consistent effort and a proactive approach are key. Download the template today [Insert link to your download page here] and take the first step towards achieving your financial goals. Start planning, start saving, and start investing – your future self will thank you!

Unlock Your Financial Future: Grab This Free 1 Page Financial Plan Template Now!

```html Unlock Your Financial Future: Grab This FREE 1-Page Financial Plan Template Now! Feeling overwhelmed by the idea of financial planning? You're not alone. Juggling...