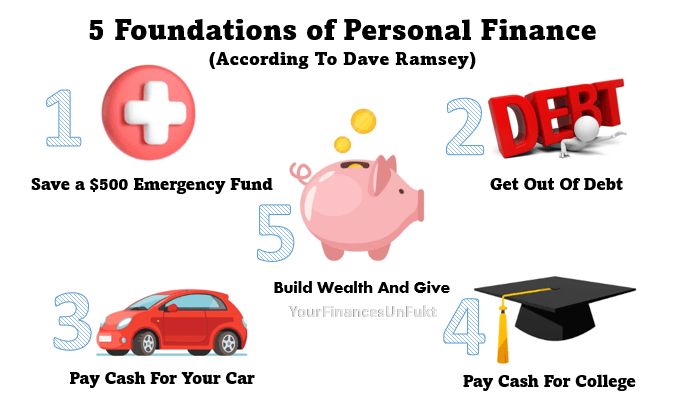

html Unlock Financial Freedom: 5 Shocking Foundations You're Missing Unlock Your Financial Freedom: The 5 SHOCKING Foundations in Personal Finance You're Missing Are you working hard, yet still feeling like your finances are a constant struggle? Many people chase complex investment strategies or quick-fix solutions without addressing the fundamental principles that truly pave the way to financial freedom. This article unveils five critical, often overlooked, foundations of personal finance. By understanding and implementing these principles, you can take control of your money, build wealth, and ultimately, achieve the financial freedom you deserve. 1. Mastering the Budget: More Than Just Tracking Spending The word "budget" often conjures images of restriction and deprivation. However, a well-crafted budget is not about limiting your enjoyment; it's about empowering you to control your cash flow . It's the cornerstone upon which all other financial strategies are built. Think of it as a roadmap, guiding you to your financial destination. Understanding the Different Budgeting Methods There isn't a one-size-fits-all approach. Finding the right budgeting method is crucial. Here are a few popular options: The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This provides a simple, structured framework. Zero-Based Budgeting: Every dollar is assigned a purpose. Income minus expenses should equal zero each month. This method demands detailed tracking. Envelope System: Physical envelopes are used to allocate cash for specific spending categories. This can be especially helpful for controlling impulse purchases. The key is to choose a method that aligns with your personality and financial goals. Experiment until you find what works best for you. (Consider linking to a resource comparing budgeting methods here, e.g., a blog post from NerdWallet or The Balance.) 2. Building an Emergency Fund: Your Financial Safety Net Life is unpredictable. Unexpected expenses like car repairs, medical bills, or job loss can derail even the most well-laid financial plans. An emergency fund acts as your financial safety net, protecting you from debt and financial hardship during these times. Without one, you’re forced to use credit cards or take out loans, leading to higher interest charges and further financial stress. How much should you save? Financial advisors generally recommend saving 3-6 months' worth of living expenses. This figure varies based on individual circumstances, such as job security and the cost of living. Aim for a high-yield savings account or a money market account to maximize returns while maintaining easy access to your funds. 3. Eliminating High-Interest Debt: The Silent Wealth Killer High-interest debt, such as credit card debt, is a significant obstacle to financial freedom. The interest charges erode your wealth, hindering your ability to save and invest. The longer you carry debt, the more it costs you. Strategies for Debt Elimination: Debt Snowball Method: Pay off the smallest debt first, regardless of the interest rate, to gain momentum and motivation. Debt Avalanche Method: Prioritize paying off debts with the highest interest rates first, saving you the most money in the long run. Balance Transfer: Transfer high-interest debt to a credit card with a lower introductory interest rate (be mindful of balance transfer fees). Consider consolidating your debts with a personal loan at a lower interest rate to simplify repayment. (Link to a reputable debt consolidation resource like Credit Karma or a similar service.) 4. Investing for the Future: Compounding Your Wealth Once you’ve established a budget, built an emergency fund, and tackled high-interest debt, it’s time to start investing. Investing allows you to grow your money over time, leveraging the power of compounding. The earlier you start investing, the more time your money has to grow. Understanding Different Investment Options The investment landscape can seem complex, but understanding the basics is key: Stocks: Represent ownership in a company. Offer the potential for high returns but also come with higher risk. Bonds: Loans to governments or corporations. Generally lower risk than stocks, but also lower potential returns. Mutual Funds/ETFs: Diversified portfolios of stocks and/or bonds managed by professionals. Offer instant diversification. Real Estate: Owning property can provide income and appreciation. Requires significant capital and management. Consider consulting with a financial advisor to create a diversified investment portfolio tailored to your risk tolerance and financial goals. (Link to a resource explaining the basics of investing, e.g., a guide from the SEC or Investopedia.) 5. Protecting Your Assets: Insurance and Estate Planning Building wealth is only half the battle; protecting it is equally important. Insurance and estate planning are essential components of a comprehensive financial plan. The Importance of Insurance Insurance protects you from financial losses due to unforeseen events. Key types of insurance include: Health Insurance: Covers medical expenses. Life Insurance: Provides financial support to your beneficiaries in the event of your death. Homeowners/Renters Insurance: Protects your property from damage or theft. Auto Insurance: Covers costs associated with car accidents. Disability Insurance: Provides income if you become unable to work due to illness or injury. Estate Planning Basics Estate planning ensures your assets are distributed according to your wishes after your death. This involves creating a will, establishing trusts (if needed), and designating beneficiaries. (Link to a resource explaining the basics of estate planning, e.g., information from the American Bar Association.) Conclusion: Taking the First Step Towards Financial Freedom Financial freedom isn't a destination; it's a journey. By mastering these five foundational principles – budgeting, building an emergency fund, eliminating debt, investing wisely, and protecting your assets – you can build a strong financial foundation. Start small, be consistent, and remember that every step you take brings you closer to your financial goals. Don't be afraid to seek professional advice and continue to learn and adapt your strategies as your life circumstances evolve. The path to financial freedom is within your reach; take the first step today!

Unlock Your Financial Freedom: The 5 Shocking Foundations In Personal Finance You'Re Missing

```html Unlock Financial Freedom: 5 Shocking Foundations You're Missing Unlock Your Financial Freedom: The 5 SHOCKING Foundations in Personal Finance You're Missing Are you working...