Receipt Scanner Filing System: Stop Losing Money – Organize Your Finances NOW!

Meta Title: Receipt Scanner Filing System: Organize Finances & Save

Meta Description: Tired of lost receipts and financial chaos? Learn how a receipt scanner filing system can organize your finances, track expenses, and save you money.

Losing track of receipts is a universal financial headache. Whether you’re a small business owner trying to maximize tax deductions or simply aiming to understand where your money goes, a chaotic pile of paper receipts is a recipe for frustration and, potentially, lost revenue. This article explores the power of a receipt scanner filing system, transforming financial disarray into organized control. We’ll delve into the benefits, steps to implementation, and the best tools to help you stop losing money and start taking charge of your finances.

Why a Receipt Scanner Filing System is Crucial

The traditional method of stuffing receipts in a shoebox or drawer is inefficient, time-consuming, and risky. Receipts fade, get lost, or are simply forgotten. This can have serious consequences:

- Missed Tax Deductions: Without proper documentation, you could miss out on valuable deductions, leading to higher tax bills.

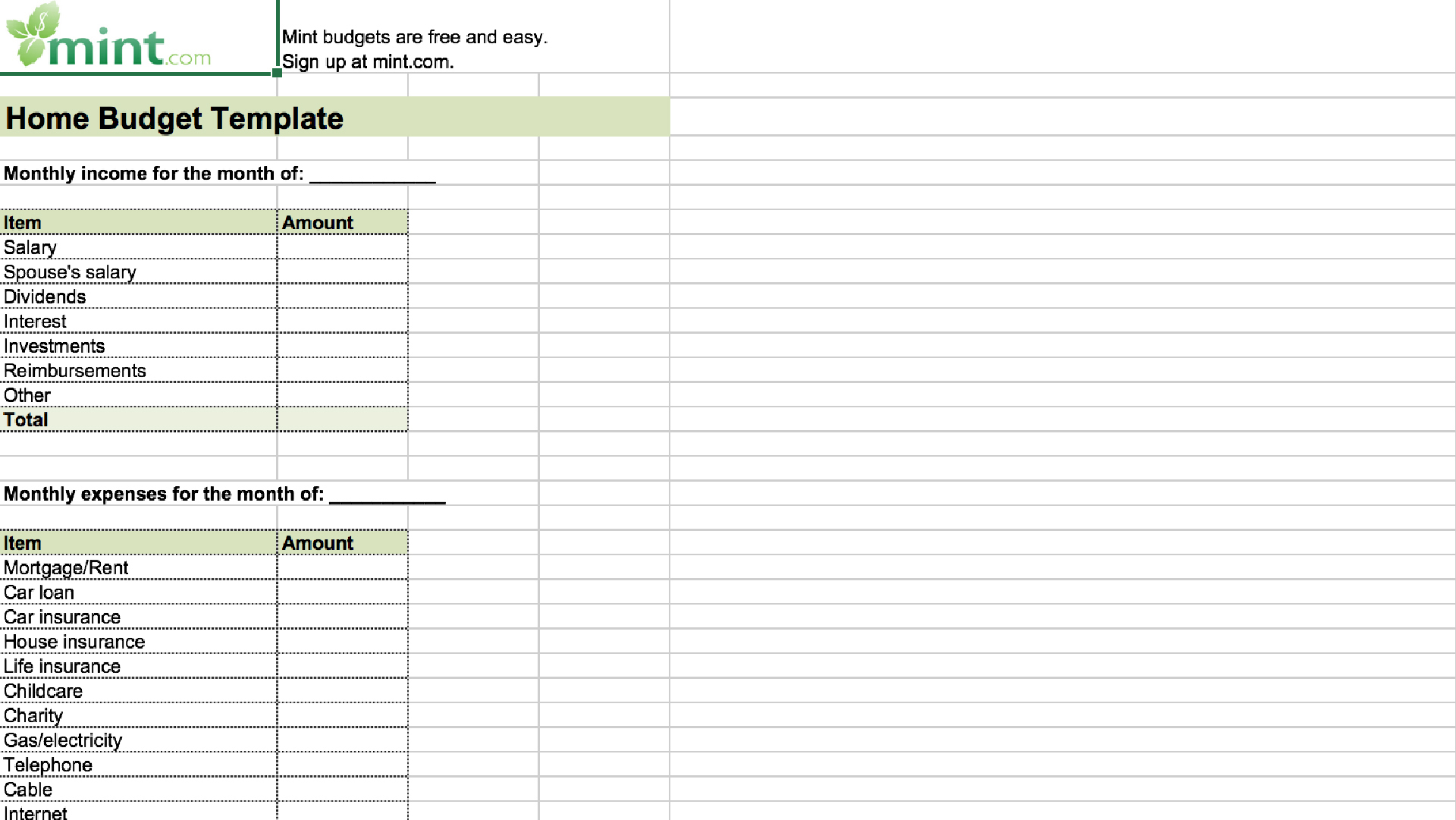

- Difficulty Tracking Expenses: Understanding where your money is going is impossible without organized records. This hinders budgeting and identifying areas where you can save.

- Wasted Time: Manually sorting through piles of receipts is a tedious and time-consuming process.

- Increased Risk of Audits: Inaccurate or incomplete records make you more vulnerable to tax audits and potential penalties.

A receipt scanner filing system addresses these problems head-on. It digitizes your receipts, making them searchable, easily accessible, and permanently archived.

Implementing Your Receipt Scanner Filing System: A Step-by-Step Guide

Setting up a receipt scanner filing system doesn’t have to be complicated. Here’s a straightforward approach:

1. Choose Your Scanning Method:

- Dedicated Receipt Scanner: These scanners are designed specifically for receipts, often featuring automatic document feeders (ADFs) and fast scanning speeds. They’re ideal for businesses with a high volume of receipts. (Consider linking to a reputable scanner review website here.)

- Smartphone Apps: Many apps allow you to scan receipts using your phone’s camera. They often include features like optical character recognition (OCR) to automatically extract information from the receipt. Popular options include:

- Evernote: (Link to Evernote website)

- Microsoft Lens: (Link to Microsoft Lens website)

- Receipt Hog: (Link to Receipt Hog website)

- Expensify: (Link to Expensify website)

- Multifunction Printer/Scanner: If you already own a printer with scanning capabilities, you can utilize it.

2. Select Your Storage Method:

- Cloud Storage: Services like Google Drive, Dropbox, and OneDrive offer convenient and secure storage. Receipts are accessible from any device with an internet connection.

- Local Storage: You can scan receipts and save them to your computer’s hard drive or an external hard drive. However, remember to back up your data regularly to prevent data loss.

- Dedicated Expense Tracking Software: Some software solutions provide both scanning and storage capabilities, often integrating with accounting platforms. Examples include QuickBooks and Xero. (Link to QuickBooks website) (Link to Xero website)

3. Establish a Consistent Naming Convention:

Create a clear and consistent naming system for your scanned receipts. This makes searching and retrieving them much easier. Consider using a format like:

[Date]-[Vendor]-[Category](e.g.,2023-10-27-Starbucks-Coffee)

4. Categorize and Tag Receipts:

Categorize your receipts based on expense type (e.g., travel, meals, office supplies). Tagging receipts with relevant keywords further enhances searchability.

5. Regularly Scan and File:

Make scanning and filing a regular habit, ideally weekly or even daily. This prevents a backlog from accumulating and keeps your finances consistently organized.

6. Review and Reconcile:

Periodically review your scanned receipts and reconcile them with your bank statements and credit card statements. This ensures accuracy and helps identify any discrepancies.

Key Features to Look for in a Receipt Scanning System

When choosing a system, consider these important features:

- Optical Character Recognition (OCR): This technology automatically extracts key information from your receipts, such as the vendor, date, and amount. This significantly reduces manual data entry.

- Searchability: The ability to easily search for receipts by keyword, date, vendor, or category is crucial.

- Cloud Integration: Seamless integration with cloud storage services ensures accessibility and data backup.

- Mobile Accessibility: Being able to scan and access receipts from your smartphone is essential for on-the-go convenience.

- Reporting and Analytics: Some systems offer reporting features that provide insights into your spending habits.

- Integration with Accounting Software: If you use accounting software, ensure your chosen system integrates with it to streamline the financial process.

Benefits Beyond Organization: The Real Value of a Receipt Scanner System

While organization is the primary benefit, a well-implemented receipt scanner filing system offers much more:

- Improved Financial Awareness: Tracking expenses provides a clear picture of your spending habits, enabling you to make informed financial decisions.

- Simplified Tax Preparation: Organized receipts make tax preparation significantly easier and faster. You’ll have all the necessary documentation readily available.

- Reduced Risk of Errors: Automated features like OCR minimize the risk of manual data entry errors.

- Increased Efficiency: Saving time and effort by eliminating manual sorting and data entry.

- Enhanced Security: Digital receipts are less susceptible to loss or damage compared to paper receipts.

Conclusion: Take Control of Your Finances Today

A receipt scanner filing system is no longer a luxury; it’s a necessity for anyone serious about managing their finances. By digitizing your receipts and implementing a consistent filing system, you can save time, reduce stress, and ultimately, stop losing money. The initial investment in time and resources is minimal compared to the long-term benefits of financial organization and control. Start today, and you’ll be on your way to a more secure and prosperous financial future.