Download Your FREE 1099 Pay Stub Template NOW – Before Tax Season Madness Hits!

Meta Title: Free 1099 Pay Stub Template | Tax Prep Made Easy

Meta Description: Get organized for tax season! Download our FREE 1099 pay stub template to track your income and expenses. Simplify your tax preparation today!

Tax season can feel overwhelming, especially if you’re a freelancer, contractor, or self-employed individual. Tracking your income and expenses accurately is crucial, and that’s where a well-organized 1099 pay stub comes in. This article will guide you through the ins and outs of 1099 pay stubs, why you need one, and how to get a free template to simplify your tax preparation.

What is a 1099 Pay Stub and Why Do You Need One?

A 1099 pay stub, often referred to as a 1099-NEC (Nonemployee Compensation), is an IRS form used to report payments made to independent contractors and freelancers. Unlike W-2 employees who have taxes withheld from their paychecks, independent contractors are responsible for paying their own self-employment taxes, including Social Security and Medicare, in addition to federal and state income taxes.

Think of it this way: if you received over $600 from a client during the tax year, they are legally obligated to send you a 1099-NEC form. This form details the total amount they paid you. But what if you have multiple clients? That’s where a 1099 pay stub template becomes invaluable. It acts as your personal record-keeping system, allowing you to track all your income streams in one place.

Why is a 1099 Pay Stub Important?

- Accurate Tax Filing: It helps you accurately report your income to the IRS, preventing potential penalties and audits.

- Expense Tracking: You can use it to track deductible business expenses, which can significantly reduce your tax liability.

- Financial Organization: It keeps all your income information in one place, making it easier to manage your finances.

- Proof of Income: If you need to provide proof of income for a loan, lease, or other financial applications, your pay stubs can serve as documentation.

Understanding the 1099-NEC Form and Your Responsibilities

The 1099-NEC form is a crucial piece of the tax puzzle for independent contractors. It’s sent to you by the payer (the client who hired you) and reported to the IRS. This is why keeping detailed records throughout the year is essential. The form includes:

- Payer’s Information: Name, address, and tax identification number (TIN).

- Recipient’s Information: Your name, address, and TIN.

- Total Payments: The total amount paid to you during the tax year.

Your Responsibilities:

- Report all income: You’re obligated to report all income listed on your 1099-NEC forms, even if you didn’t receive a form (though you are still required to report income even if you don’t receive a 1099-NEC).

- Pay self-employment taxes: You’re responsible for paying both the employer and employee portions of Social Security and Medicare taxes.

- Deduct legitimate business expenses: You can deduct ordinary and necessary expenses related to your business, which can significantly reduce your taxable income. (See IRS Publication 334, Tax Guide for Small Business for detailed information on deductible business expenses.)

- File Schedule C: You’ll use Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), to report your income and expenses.

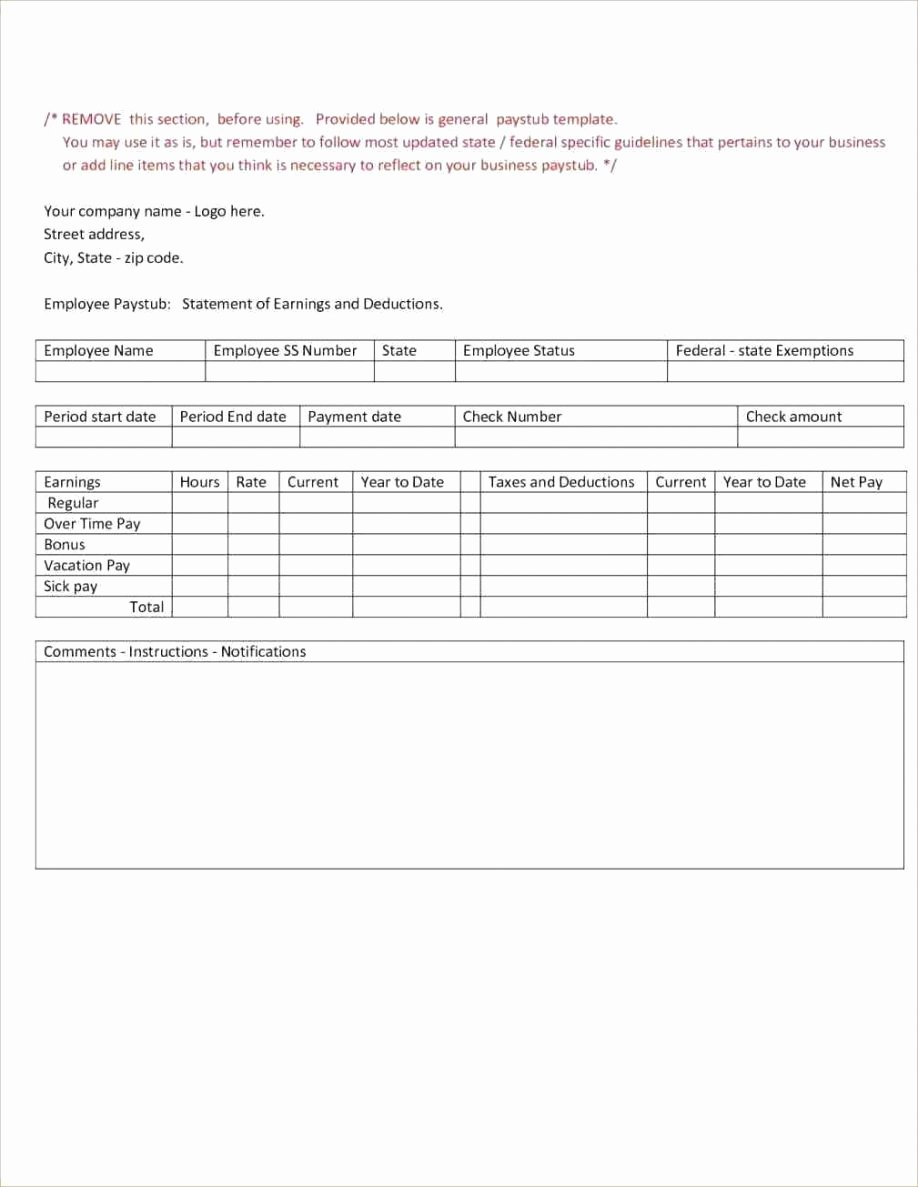

Download Your FREE 1099 Pay Stub Template

To help you stay organized and prepared for tax season, we offer a free 1099 pay stub template. This template is designed to be user-friendly and easy to customize.

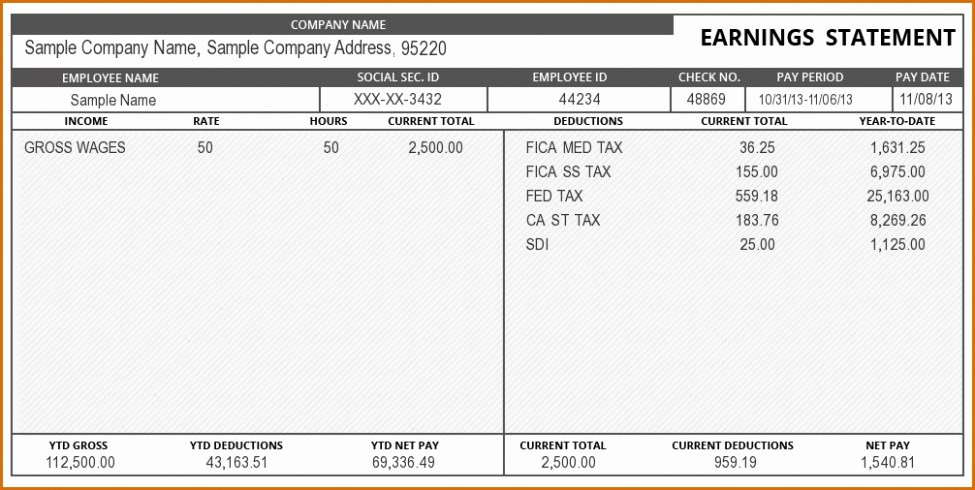

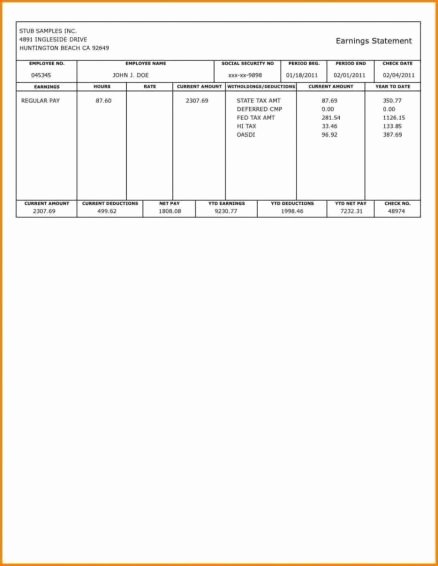

What the Template Includes:

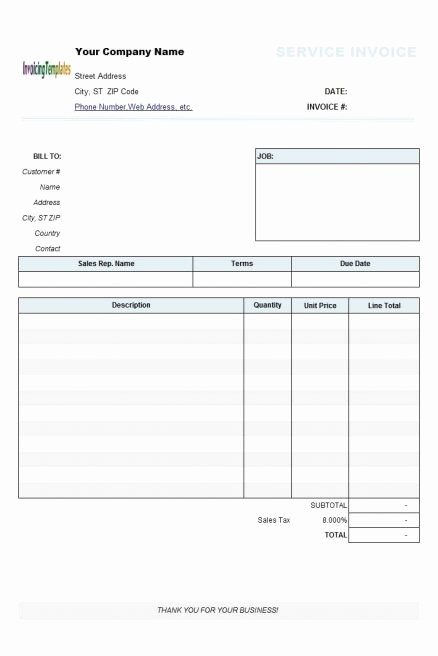

- Income Tracking: A section to record the date of payment, the client’s name, and the amount received.

- Expense Tracking: Dedicated space to list and categorize your business expenses, such as office supplies, travel, and marketing costs.

- Tax Calculation Area: Fields for calculating self-employment taxes, estimated tax payments, and potential deductions.

- Summary Section: A summary of your total income, expenses, and estimated tax liability.

How to Use the Template:

- Download the template: [Insert Link to Your Free Template Here - e.g., Google Sheets, Excel, or a PDF]

- Customize it: Add your business name and any other relevant information.

- Enter your income: Each time you receive a payment, record the details in the income section.

- Track your expenses: Keep receipts and record your business expenses in the expense section.

- Calculate your taxes: Use the template to estimate your self-employment tax liability and track your estimated tax payments.

Tips for Maximizing Your Tax Savings

Beyond using a 1099 pay stub template, here are some additional tips to help you maximize your tax savings:

- Keep Detailed Records: Maintain meticulous records of all income and expenses. This includes receipts, invoices, bank statements, and any other documentation.

- Separate Business and Personal Finances: Open a separate business bank account and credit card to easily track your business transactions.

- Understand Deductible Expenses: Familiarize yourself with common business deductions, such as home office expenses, vehicle expenses, and marketing costs. (See the IRS website for detailed information on deductible expenses.)

- Make Estimated Tax Payments: Pay estimated taxes quarterly to avoid penalties.

- Consult a Tax Professional: Consider consulting a tax professional for personalized advice and guidance. They can help you navigate the complexities of self-employment taxes and ensure you’re taking advantage of all available deductions.

Case Study: Sarah’s Success Story

Sarah is a freelance writer who started using a 1099 pay stub template last year. Before using the template, she struggled to keep track of her income and expenses, often feeling overwhelmed during tax season. However, with the template, she was able to organize her finances, accurately track her income and expenses, and identify deductible business expenses she had previously overlooked. This resulted in a significant reduction in her tax liability and a much less stressful tax filing experience.

Conclusion: Stay Ahead of the Tax Season Curve

Tax season doesn’t have to be a source of stress and anxiety. By downloading our FREE 1099 pay stub template, you can take control of your finances, track your income and expenses with ease, and prepare for a smoother tax filing experience. Start organizing your finances today and stay ahead of the tax season madness! Don’t delay – [Download Your FREE Template Now! – Link to your download].

Remember: This information is for general guidance only and does not constitute tax or legal advice. Consult with a qualified tax professional for personalized advice.